Investing in property for rental purposes can be a lucrative endeavour, offering both long-term capital gains and immediate rental yield if managed effectively. For landlords, the key to maximising their investment lies in a combination of strategic planning and attentive oversight of their rental properties. Keeping abreast of market trends, understanding the nuances of property management, and maintaining a competitive edge are essential components to enhancing the value of a rental investment.

Strategies for Optimal Investment Returns

In seeking the highest returns from the buy-to-let market, property owners should focus on thorough market assessment, understanding the mechanics of yield and growth, and continuously refining their investment strategies.

Assessing the Buy-to-Let Market

To make informed decisions, buy-to-let landlords must analyse the current state of the UK property market. This includes identifying areas with high demand for rental properties and weighing the potential for long-term appreciation. Key indicators to consider are employment rates, local development plans, and transportation links. Studying these factors helps investors target locations with the most promising prospects for buy-to-let investments.

Understanding Yield and Capital Growth

Yield is a crucial metric for measuring the performance of an investment property. It quantifies the annual return on investment compared to the purchase price, commonly expressed as a percentage. The rental yield focuses specifically on income generated from tenants, while the overall yield may also account for capital growth—the increase in property value over time. Both elements are vital for a balanced assessment of a property’s profitability.

Fine-Tuning Your Investment Strategy

With a solid understanding of the market and key financial metrics, property investors can fine-tune their strategies to optimise their investment returns. They should consider diversifying across different property types and locations to mitigate risks. For ongoing success, maintaining a flexible approach to the rental market is essential, with regular reviews of rental prices and property conditions to remain competitive while ensuring a steady return on investment.

Financial Management for Property Owners

Effective financial management is critical for owning rental property, involving meticulous planning and understanding of financial instruments, tax legislation, and market trends. The following subsections provide practical advice for enhancing the profitability and stability of rental investments.

Mortgage and Finance Options

Property owners looking to finance their rental properties have various mortgage options, including buy to let mortgages, which are specifically designed for investment properties. One should consider the interest rates and mortgage payments carefully to ensure they are affordable and in line with the expected rental income. It’s also important to maintain a good financial situation to access the best mortgage products and interest rates. Additionally, setting aside savings to cover unexpected costs can prevent financial strain.

Tax Responsibilities and Benefits

Understanding tax responsibilities is essential for property owners. This includes being aware of stamp duty, buy-to-let tax, and tax benefits such as mortgage interest tax relief, which can reduce the overall tax bill. Accurate record-keeping supports claimable expenses and timely tax submissions help avoid penalties. Additionally, using a well-organised business account could streamline financial transactions and paperwork.

Controlling Costs and Maximising Revenue

To maximise rental property profits, controlling costs is as important as generating revenue. This involves diligent tracking of running costs, like insurance, letting agency fees, and maintenance expenses. Owners should regularly review their fees and compare market rates to ensure they are not overspending. Rent should be set competitively to attract tenants while ensuring it covers the costs and generates profit. To reduce the risk of rent arrears, thorough tenant screening and the use of direct debits from reliable business accounts can ensure consistent cash flow. Regular financial reviews can reveal opportunities to optimise costs and increase rental income.

Maintaining and Enhancing Your Property

Property owners should recognise that proactive maintenance and targeted enhancements can preserve and increase rental investment value. They must also ensure compliance with legal safety standards to protect their investment and tenants.

Regular Maintenance and Repairs

For a rental property to remain competitive and appealing, the property owner should schedule regular maintenance checks. From ensuring that the garden is well-kept to confirming that all plumbing and electrical systems are functioning correctly, a proactive approach minimises future repair costs. Engaging a property manager can streamline this process, with tenancy agreements often highlighting the importance of keeping the property well-maintained.

- Monthly Maintenance Tasks: Test smoke alarms and security systems, check for leaks, and inspect appliances.

- Annual Maintenance: Schedule professional inspections of roofing and rainwater drainage systems, with companies like Capcon Engineering specialising in these areas.

Value-Added Renovations

Strategic renovations, big and small, have the potential to greatly enhance property value. Updating the kitchen and bathroom with modern fixtures can command higher rent. Even small changes, such as adding added extras like high-quality furniture or advanced security systems, can make a property more attractive to tenants.

- Kitchen: Upgrade appliances or refinish cabinetry for a fresh look.

- Bathroom: Replace outdated taps or install new tiles for a modern appeal.

Legal Compliance and Safety

Remaining legally compliant is critical, not only for the safety of the tenant but also to protect the property owner from potential liabilities. Installation of a comprehensive fire alarm system is important, both for tenant safety and compliance with safety regulations. Regular safety surveys and adherence to the terms set out in the lease are necessary for maintaining the legal standing of a rental property.

- Surveys: Conduct periodic surveys to identify potential hazards.

- Compliance: Ensure all safety measures, like fire and security systems, are in place and operational.

Taking care of these maintenance, renovation, and compliance aspects will help in maintaining the quality, security, and desirability of a rental property.

Finding the Right Tenants

The process of finding a suitable tenant is critical to maintaining a successful rental investment. Property owners need to adopt a structured approach to attract high-quality tenants who are likely to pay rent on time and maintain the property well.

- Effective Marketing: First, one must market the property effectively. This includes utilising online platforms, which are essential for reaching a wide audience. High-quality photographs and detailed property descriptions enhance the visibility of the listing.

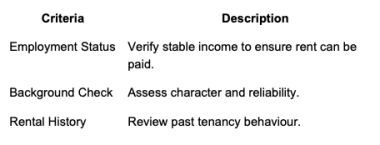

- Tenant Screening: When inquiries start coming in, thorough tenant screening is a must. This includes credit checks, right-to-rent checks in the UK, and references from previous landlords. An applicant’s rental history can be telling of their future behaviour.

- Viewings and Questions: Preparing the property for viewings is also key. Prospective tenants appreciate a clean and well-maintained property. During viewings, landlords should ask pertinent questions to understand the tenant’s needs and ensure alignment with the property’s offerings.

Implementing these strategies with due diligence helps a landlord secure a tenant who will care for the property and fulfil their tenancy obligations reliably.